Our Services

If you are looking for a blend of personal service and expertise, you’re in the right place… by combining our 30+ years of accounting and business experience and the energy and friendliness of our staff, you will receive close personal and professional attention.

We offer a broad range of affordable, experienced, and friendly services for business owners that specialize in construction management, contractors and the medical field

- Compilation Reports Required By State Boards For Licensing

- Liability Insurance Audits

- Worker Comp Audits

- Job Profitability

- Loan Applications

- Financial Advisory Services

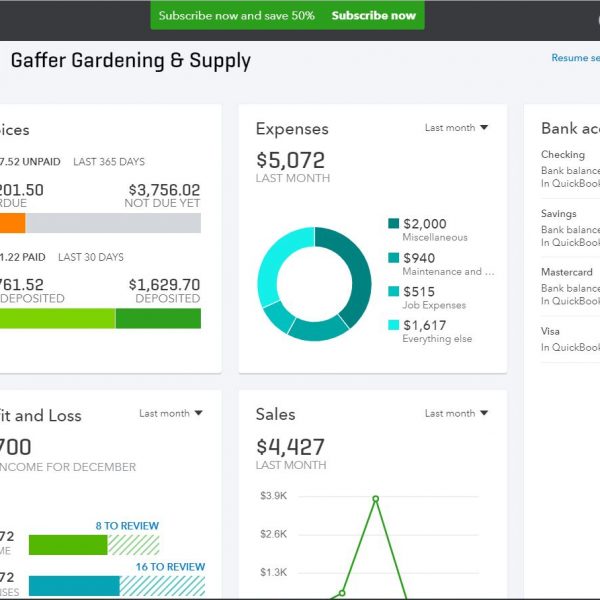

- Business Accounting Services

- Individual & Self-Employed Accounting

- Tax Preparation For Business & Individuals

- Quickbooks Setup & Training

Previous

Next